Hot topics click link for more

In Big Business

Every business segment follows accepted and time-honored trajectories. Business school professors have written it all down, many times. MBA students memorize every word. These cycles, described in charts, graphs and tables, follow some sort of natural order. Businesses only tweak - or twerk - the inevitable path to obscurity. Today, certainly in the media sphere, nobody believes any of that.

Every business segment follows accepted and time-honored trajectories. Business school professors have written it all down, many times. MBA students memorize every word. These cycles, described in charts, graphs and tables, follow some sort of natural order. Businesses only tweak - or twerk - the inevitable path to obscurity. Today, certainly in the media sphere, nobody believes any of that.

Most media mergers and acquisitions are rather trance-like. Bland lawyers mingle with equally bland accountants to engage in an incomprehensible kabuki to carve up companies, usually without the knives, and dice up the money. A century ago this was so much more fun, at least made for the movies. Alas, we return to those glory days of high drama.

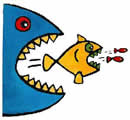

Building scale has long been the favored business strategy. Bigger is, quite naturally, stronger. Smaller is just a lot of work. It is just the same for the media world as, say, the oil business or, in recent decades internet technologies. Bigness has its detractors; enemies even. This has only grown with big associated with bad, particularly super-big, particularly in popular headlines. Empirical evidence is far less incriminating.

Joint ventures are reasonably robust corporate structures. Typically, they conduct business through a defined set of rules. There’s a lot of sharing. Companies like joint ventures until they don’t. And that’s how it’s supposed to work.

Phone company jokes have never gone out of vogue. Long represented as that anonymous voice on the line at dinner time demanding payment for a bill already paid or the customer service line that’s always out of service, the phone company is a model irritation. Now called telecoms, the old habits never fade. Nobody, however, laughs about the money they make.

It’s one of those seasons when everybody is a buyer and everybody is a seller. Marketplace changes have run smack into new technologies and a whole different media consumer. On top of that, money is no object.

Scanning recent radio audience estimates the suffering is clear for music stations. Disruptions in the daily routines opened a bigger hole than first expected. Streaming services and podcasts ran right through it. They have the technology, the money and customers quite willing to sample the serendipity.

The perilous decline in recent years of operating profits for news publishers has been widely chronicled, often with overarching sadness. Fallen newspapers are mourned with obituaries like those they once published. The sorrow has deepened immeasurably as the news model rapidly replacing the local publisher is both online and highly suspect, possibly related. Supporters of journalism and, even, news publishing are likened to museum curators. But hope springs eternal.

Audiovisual rules in most countries have been set in stone for ages. More precisely, regulatory levers meant to keep a thumb on operational, commercial and financial behaviors date from the pre-digital era. Early deregulation efforts, largely, did not provide the desired effect of giving bracing control to broadcasters. The internet arrived. Mobile phones arrived. Netflix arrived. Consumers went with the flow.

Big media companies take their merger and acquisition activities quite seriously. There are not spur of the moment decisions. Legions of lawyers, accountants and senior managers are involved. Delivering a good deal for the boss can result in a hefty bonus. If it doesn’t work out, well, there’s always work from home.

When the Soviet Union collapsed, local oligarchs suddenly appeared in those various countries taking over every sort of business including media. Actually, they had always been there. Foreigners also raced in with bags of money, with or without customary introduction, snapping up media outlets. These foreigners were typically referred to as investors or entrepreneurs. Oligarch continues to be a pejorative term. Investor is an honorarium. One group group stuck around and the other, mostly, headed for the exits.

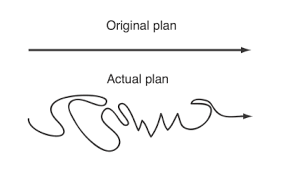

Business strategies generally follow one of two basic forms. There is the slow and plodding make-no-mistakes kind. On the other end of the spectrum we have go-fast-and-break-things. The later is heralded as the way of the future, digital everything, appealing to the attention-deficit times. The former is seen as just a relic of the last century, soon to fade away or be gobbled up. There are many examples of each within the media world. In the middle there is always rearranging lines on the spreadsheet.

Film and television awards have long-standing strength. The industries, their luminaries and reporters who cover same love them. Winners, losers and, of course, upsets all make great copy. Fans like these televised awards, now virtual, for the same reasons. But there’s one more; awards focus attention. And these days attention is hard to channel.

Mergers and acquisitions in the media sphere have been moving toward more strategic dimensions. That’s not to say tactical competitive deals are out. These are just on the backburner as national competition authorities press harder on operational issues like employment and debt. As usual, banks and investment funds are cleaning up, literally and figuratively. There are targets of opportunity and many games to play.

The brightest minds, at least the busiest, continue to explore the decline of trust in, well, everything. Institutions are regularly named and shamed. Media is not spared. A level deeper are classes and races. Voices of doom chide the very idea of society. Not very pleasant stuff and those looking most deeply into it all are stuck for solutions.

As it rapidly spread throughout the world last spring, the coronavirus - now referred to as COVID-19 - wreaked havoc on events. Conferences and trade shows were postponed or cancelled. These events always offer keynote speeches and panel discussions with leading executives plus new goodies on display. On the side, probably more important to attendees, are deals, hobnobbing, more deals, dinners, parties, flirting and more deals, not to forget passing out CVs. All of a sudden, news reporters and editors found far fewer choice observation posts in key industries, including their own.

Surge is a common term these days. Coronavirus COVID-19 infections are surging again after a bit of a respite from the first surge earlier in the year. That’s not all. There’s been a surge in interest in chess and other board games. Online shopping is surging, but that’s not necessarily new, along with delivery services. Housing prices and costs are surging in some locales, notably distant from urban centers, but not always. Silver and copper prices are surging, perhaps related to housing and solar panels. Psychiatrists are seeing a surge in anxiety symptoms. Unemployment is also surging.

Deft operators are always on the lookout for opportunities. Objectives are quite clear, strategic advantage tops the list. Leverage sometimes creates these opportunities. Power is often the leverage and the objective. Money is no object. And it is helpful to have a model.

Streaming media has been around long enough to cast off that start-up image. Certainly, some of that remains. The automobile industry has a hundred year lead, banking more than 500 years. But business moves fast, except where it doesn’t, these days. And the business world wants to follow the winners right now.

The great growth of the media sector during the last two decades of the last century has undergone several reversals in this century. There have been spurts, mostly enabled by digital transition, which has equally brought on consolidation and other disruption. By consequence there are many highly experienced media people looking for that next opportunity. And at the top, social distancing accepted, fewer doors are open.

Digital transformation is taking yet another leap. Skeptics have been sent out to pasture, mostly. Masters of the consulting universe, always making fortunes on change, have been pushing all industries to embrace technology. And so they are.

Digital transformation is taking yet another leap. Skeptics have been sent out to pasture, mostly. Masters of the consulting universe, always making fortunes on change, have been pushing all industries to embrace technology. And so they are.

Only the least informed observers dispute that disruptions roiling from the coronavirus pandemic are serious and far reaching. Fair weather friends exclaiming it will all just go away are being ushered to the far end of the bar, maximum social distancing. Pollyannas had their moment, which now has passed. There is no sunny side of this street.

As the current societal anomie careens on a pathway of uncertainty and anxiety there are a few untouched norms. First, everybody wants data, preferably more data. This includes crazy data, but that’s a subject for psychotherapists. Then, totally related, hedges funds continue doing what it does best, dissembling. These are both good reasons to stay away from crowds.

Almost everybody who expounds on anything has a thought or twelve about how everything has changed. Others more factually challenged harped on the sure bet of getting back to normal. And then there was "new normal," slowly being defined by the same folks who emblazoned the old normal. TV Land is scouring the mountains and fields for clues. The advertising people are practicing yoga, alone.

For a day it was the biggest business story other than oil prices, unemployment and coronavirus. And it connects to all, not just obliquely. Such it is with headlines. Each one has a moment. They all blur together.

A big part of many TV shows has been the live audiences. Broadcasting studios have long been magnets for tour groups. Sometimes this includes watching a show as it is produced. It’s exciting for TV fans. For broadcasters it is part of public outreach. A change is upon us.

The media world is no place for the faint of heart. It is also, it seems, no place for the small. Scale, of course, has long been touted as the greatest of all competitive advantages. That logic fell out of favor as the digital revolution arrived, further excited by private equity fund managers. Agility became the favored flavor. Being speedy and clever is still seen as beneficial but nothing beats raw brawn.

For the classically trained, a business model is trained on opportunity. A customer need is filled by a product, price negotiable. The enduring challenge is identifying the need in terms of a deliverable thing or service. More recently, delivery has become the overwhelming need. Happiness is sure to follow.

As the Soviet bloc crumbled in Eastern Europe great opportunity opened. Western investors, many with broadcasting and publishing experience, seized the chance as old state structures vanished. They brought money and talent. Success was at hand. Things changed. In the last decade or so, many of these investors walked away. Some ran. Most, now, are gone. The tales are illuminating.

Most business sectors are fairly insular, internal structures strong and skill-sets narrow. In this respect, media and advertising businesses operate like aerospace, agriculture, mining and pharmaceuticals. Financial services touch them all. And, now, so do digital technologies. These are new inputs, sometimes welcome and sometimes not.

Most business sectors are fairly insular, internal structures strong and skill-sets narrow. In this respect, media and advertising businesses operate like aerospace, agriculture, mining and pharmaceuticals. Financial services touch them all. And, now, so do digital technologies. These are new inputs, sometimes welcome and sometimes not.

Employment is an established measure of economic stability. Jobs are more personal. There was a bit of schadenfreude in news reports at the beginning of the week with hundreds of bankers streaming out of impressive buildings sobbing, carrying the personal possessions that once decorated the cubical, heading to the nearest bar. Big banks, these days, are not universally loved. The worst time for terminations, say human resources experts, is just before holidays. But, sometimes, the human resources people are the first to go.

History shows how newcomers are righteously shunned by the old guard. This dates back to the Roman Empire and history shows the peril. Every tradition holds on - or holds out - until its creaking and groaning voice is overwhelmed by a new sound. The newcomers, then, relish in being the loudest noise in the valley.

Big mergers and acquisitions - media and otherwise - almost always result in a period of adjustment. This can last years as executives and shareholders begin executing new operating and financial plans. Those taking on debt tend to shed the odd bits. Those with newly found piles of cash tend to circle the wagons. Everything changes, especially the names.

Disregard, please, the dire warnings of intertwined social and mobile media spinning a web around television and strangling it. Technology people or advertising people or advertising technology people plant most of this. TV will remain the leading mass media around the globe for a few more years, at least until the next climate event. People really don’t like interacting, particularly with bots. It’s what they do for work or what passes for work. People like to be amused or, at least, distracted. The TV people know this.

Years ago, so far from today most people can’t remember, the legends of digital creation told everybody who would listen that nothing would be the same. They were, largely, ignored. Bit by bit - byte by byte - their message turned true. People liked many of these digital marvels and discarded much of what had come before without overly intellectualizing their decisions. This made some folks absolutely crazy.

Television people are a predictable lot. The herd travels far and wide, nibbling here, kicking there, in search of the next big thing. Some stray, occasionally, but never too far. TV viewers seeking bright, shiny and new are definitely one step ahead. This is the continuing challenge.

Anybody hanging around the radio and television world for more than a blink learns that show hosts have a finite product life cycle. Audiences change. Popularity - or notoriety - can stretch longevity only so far. Good managers know this.

Telecoms know one thing better than everybody else: billing. These giants of telecommunications, once known colloquially as telephone companies, have perfected this skill over generations. Of course, services provided have adapted to evolving customer interests. Wires are out. Clouds are in. Billing never changes. This has made telecoms masters of the universe.

Media barons hold an outsized standing in public consciousness. If the journalistic pen is powerful, television is almighty. That would make the web and social media omnipotent, as they believe. Well-known media barons are fading away; some by choice, some not. Climbing without a tether can be dicey but hanging is forever.

Entering a transitional media market is always a leap of faith. Investors weigh opportunity with costs, always considering the learning curve. To thrive several conditions are helpful; from economic and political to social and cultural. When transition stagnates - or worse - the next leap is to the exits.

It is always best, we have learned, to take with a grain of salt any “breaking news” headline. OK, a barrel of salt. Maybe a boat-load of salt. We must temper the excitement no matter how, well, exciting.

It is always best, we have learned, to take with a grain of salt any “breaking news” headline. OK, a barrel of salt. Maybe a boat-load of salt. We must temper the excitement no matter how, well, exciting.

Music streaming is hot. The music streaming business is a little more difficult. The subscription model is in, ad-serving not so much, at least with investors. Artists and their publishers wave their hands - or lawyers - and rights fees are raised. The biggest of the music streamers have deep pockets and, maybe, time to play. Investors see supply and demand. It’s not like coal mining.

Nobody in business, media or otherwise, wants to be the little guy. Hence, all executives are schooled in thinking big. Their bankers tell them to think big because the paper work for a big deal is just the same as a small deal. There is no incentive to be anything but big.

Strong news brands, by and large, have discovered two things recently. Number one is the fragility, to be generous, of advertising revenues, digital and otherwise. Second and just as important is the rise of subscription revenue for big news brands like the New York Times and the Guardian. In addition, though most significantly in the US market, is the Trump Effect, passionate foes and fans of US president Donald Trump are paying to see what they want to see.

TV land has never been so complicated. Viewers can find everything and anything, everyday and any time, on wall-sized screens or wallet-sized. Take your pick, the TV folks have it all.

Transitional media environments create considerable froth among top executives. The hardest-charging eventually want to “seek new opportunities” or are asked. Stability is a warm-fuzzy memory as audiences, platforms and owners change. Growth - however possible - is still the priority. Getting there is the journey, not the destination.

Loyalty is a highly admired trait. It is necessary for soldiers, military and otherwise, to know that leaders and compatriots have their back, so to speak. To be resolute in battle means reciprocating. It is a matter of survival. In business, however, loyalty ends at the bottom line. This is a good thing.

Business and financial news outlets are distinct among information providers. They are many and varied; some international, others quite local. While many report news broadly, the key ingredients have always been facts and figures mixed with rumors sufficient to satisfy investors, shareholders, executives and all who watch them. All these outlets have struggled, some more than others, with digital competition. Credibility is of the utmost importance.

Getting money from the web is no longer about simply selling ads. There’s branded content, merchandising, talent management, all kinds of goodies. Multiple revenue streams excite investors, traditional ad money so last century. The quest for scale, however, is eternal.

Getting money from the web is no longer about simply selling ads. There’s branded content, merchandising, talent management, all kinds of goodies. Multiple revenue streams excite investors, traditional ad money so last century. The quest for scale, however, is eternal.

The digital age has made one factor more important than all others: scale. To thrive, if not only survive, media operators view consolidation as primary business strategy. Shareholders and stock traders agree; other insecurities pale. Above all, what is familiar is favored.

In business - as well as everything else - all things eventually come to an end. This is not doom and gloom. A favorite brand or product disappearing might well-up sadness and tears but, voila!, there is always something else to replace it. Generations change and bring with them different ways, sometimes better and sometimes just, well, different.

Executives are much happier exploring new opportunities than tackling headaches arising from the normal course of business. Shareholders are only happy when profits and dividends flow. The most successful - and thriving - management strategies keep sharp attention on happiness. When throbbing headaches invade the spirit pain relief becomes an object. Holidays are helpful.

The air between traditional and new media is both rousing and scary. One is powered by legacy, the other by change. These are strong instincts, in their own right. Different languages are spoken, time measured by the clock or the deal. Asset value descends from the great void rather than shelf life.

Uncertainty is always stress inducing. People quite normally look at possibilities, alternatives and opportunities. The human mind, definitely analogue, checks the landscape for clues. Favored outcomes are, more often than not, blinded to reality. That saber-tooth tiger, headed toward extinction, can still eat you.

Owning and operating a media organization is a tough slog in the digital age. There have been dropouts despite the alluring promise of fame, fortune and show business. For every one seeking escape new media operators spring up, plenty of them. Not all have the same aspirations. And we know who they are.

The digital age has changed everything; trite, now, but still true. Broadcasting and publishing are so last century, when engaging each individual customer was considered déclassé. The media sphere is now strictly retail; apps as aisles, clicks and swipes the points-of-purchase. Stars are now showcases, changing regularly, and headlines point to the check-out line. It’s a different business every day.

The great digital dividend has opened vast new opportunities for film and television productions, not to forget animation, games and live events. And the demand for all that is creating more demand, a cycle, perhaps virtuous, maybe silly. Shareholders have their demands, too; sometimes not in synch with anything else. With so much fun - and money - available nobody seems to want to share.

Big investors and venture capital firms are watched carefully for indicators of financial trend. These money pipeline innovators, some would call them manipulators, apply their skills quite narrowly: make more money with less risk. Tech companies - including media tech - are played like poker chips. Of course, the table always wins.

Radio broadcasters, who once warded off threats of extinction from evil television, are feeling considerable anxiety inflicted by the streaming services and, more importantly, the notoriety they have achieved. Music, popular and otherwise, has filled the radio airwaves, interspersed with ads among many, occasionally DJs, sometimes with jokes, sometimes weather reports. Video, MTV and the like, did not “kill the radio star.” Audio streaming services enabled by mobile platforms are, at least by appearance, grabbing radio’s default audience, music fans.

Everything is now a challenge. Sitting back to enjoy the fruits of good labor is off the agenda. More competitors are coming. Some have money. Some have ideas. Some have a plan. The future howls like a cold north wind for the rest.

From management consultants to corporate raiders the message is the same: Execution is everything. Ideas, wonderful as they are, spring up everywhere. Only a few attract listeners, viewers, readers or, best of all, money. Leaders may be credited for grand plans but putting them in motion is the real skill.

From management consultants to corporate raiders the message is the same: Execution is everything. Ideas, wonderful as they are, spring up everywhere. Only a few attract listeners, viewers, readers or, best of all, money. Leaders may be credited for grand plans but putting them in motion is the real skill.

With short attention spans and an anxious nature investors don’t need a lot of input for buy-sell decisions. The digital era has given them many tools. And they certainly like betting on change. They only need be right 51% of the time so the slightest nudge sets them off.

Almost everybody likes a surprise, children in particular and television viewers. Accountants do not. The TV world thrives on the serendipity of something new intersecting with something known. Creating that surprise is the art attracting viewers and, now, subscribers. There is no formula.

Media luminaries through most of this century have taken every opportunity to belittle the online “culture of free,” customers disregarding traditional pathways of commerce for the cornucopia that is the internet. A legal bit torrent was unleashed against those defying the will of content masters. The result has been much as expected; threats bore no fruit, the internet adapted. Consumers aplenty have decided which items on the media menu they will and will not pay for.

Famous executives, media and otherwise, are easily quotable. Their careers depend on invigorating board meetings and shareholders, insight notwithstanding. Those chosen to lead the most prominent in today’s media sector know very well the importance of the right words at the right time and memories can be quite short. For that they are thankful.

Reordering the media world is taking a pace, if not dimension, only a few saw coming. Opportunity is created in all this disruption, certainly for the few most nimble or most lucky. Unease is palpable among those trying to make ends meet or trying to meet the end. The spotlight follows the most important actors, at least until the curtain falls.

If there was one single take-away from the MIPTV market show in Cannes last week “Game of Thrones” was it. Selling to TV buyers means competing with high-quality - and quite expensive - shows that viewers everywhere know, have seen and talk about. Big shows are in demand; the rest just fills time.

The meteoric rise of media executives always attracts considerable attention, adding to the enduring narrative of success in this highly visible arena. Big ideas, working hard or having the right connections most often illustrates the careers of these winners. That light is also visible, however briefly, when media stars fall back to earth.

Pressure on media executives is often insurmountable. Even those with impeccable records of service are called to painful duty. Rising to that call can be hugely rewarding. Failing, quite often, is the road to perdition.

The media world attracts the most interesting people, often quite colorful, sometimes rather dark. Where that dark-side takes hold, cleansing is a long process accomplished by repeated hand-washing, hampered by hand-wringing. There is merit in feeling clean, more, perhaps than being clean.

Major events always offer journalists vast opportunities to explore a host country, seeking color and controversy. Editors demand new stories, reporters comply. Media business writers have, generally, three themes to chase: money, digital and weirdness.

Last year was generally good to big media companies. Distribution companies, largely satellite and pay-TV, benefited greatly but content companies, largely TV and film producers, held their own. The web is evermore powerful and publishing only starting to recover.

Supply and distribution disputes, however ugly, are common and, largely, the usual means by which companies align and realign their relationships. Negotiations can either be strategic or tactical, gain an advantage or apply pain. The biggest or most powerful aren’t always the victors. The smartest are.

The television environment is changing so fast only the fans, it seems, can keep up with it all. First, they wanted to control the schedule. Now they’ve given up the entire idea of schedule. The digital dividend has given more than new channels and new shows. There’s a new kid in town.

The appetite for live news has never been greater. Drama in progress is an audience magnet. The news business is also a magnet, commercially attractive and highly competitive. The digital dividend has made this possible and very challenging.

The appetite for live news has never been greater. Drama in progress is an audience magnet. The news business is also a magnet, commercially attractive and highly competitive. The digital dividend has made this possible and very challenging.

Russian media is, if anything, full of intrigue. From Western eyes, it’s also full of controversy. This certainly extends to the rather vibrant new media scene. Color it complicated.

Companies move through stages, entirely predictable. Financial investors also have their phases. Circumstances, certainly, dictate much of the flow but, like the sun rises and sets, investors move on to newer opportunities. Companies either evolve or fade away.

Video portal YouTube just had an anniversary. The undisputed global market leader is nine-years old, almost qualifying as an old dog in the media-tech world. What YouTube did for the web, it’s now doing for television. Competitors would like to breath the same air.

Broadcasters can fall foul of regulators, even public opinion, for touching sensitive subjects. There can be fines and worse. Where broadcasting is under one thumb or another viewers search high and low for anything interesting, maybe controversial, sometimes annoying. But bland TV is never threatening.

Opportunity and cash are charting the ebb and flow of recent media transactions. With most developed markets, strategic investors are buyers and financial investors are sellers as valuations continue to rise. In developing markets, media asset values have plummeted to historic low levels, changing the equation. Speculators are having a field day.

Despite choruses from the highly quoted media thinkers of our day, traditional media – publishing and broadcasting – continues to have the one thing hard to buy at any price but that the rich and powerful want more than anything. Influence is brighter than gold. Quite hot to the touch, too.

Consolidation is a matter of course. In market economies, tough times force companies to expand cash-flow by acquisition. Better times encourage new entrants and new ideas. But where the media sector is viewed through a different prism consolidation is simply a matter of control.

It’s the season for change agents. Helicoptered in from the home office, turn-around specialists are single-minded and short on patience. They prefer core businesses, preferably with fewer employees. Competitors, though, are happy to see them.

Big media houses are finishing 2013 with a sense of renewal. The financial picture for most isn’t getting much better but it isn’t getting much worse. Digital transition is a foregone conclusion but the end result remains hazy. Possibilities, once so numerous, all lead one direction.

Big media houses are finishing 2013 with a sense of renewal. The financial picture for most isn’t getting much better but it isn’t getting much worse. Digital transition is a foregone conclusion but the end result remains hazy. Possibilities, once so numerous, all lead one direction.

Shifting financial winds continue to deposit sand in the doorways of major media groups. Some shareholders maintain faith in the media sector, albeit with conditions. Others are less sanguine. Consolidations, mergers, break-ups and more turmoil may have a cathartic effect.

There are some who believe online media is a bubble about to burst, a house of cards so to speak. With the advertising model under constant repair, paywalls and subscriptions seem the most reliable revenue streams. Media consumers are evermore enticed by unique content so long as the price doesn’t wreck the household budget and broadband speed is sufficiently high. Staying in the middle of it all is the emerging business model.

Television is in big trouble. Media buyers under the internet’s spell are pushing ad rates lower. At the same time new digital choices cannibalize audience and revenue streams. The result is painful and may send free to air TV the way of newspapers.

Challenging times call for decisive action. Some media operators choose to stay the course, albeit with fewer resources. Others take the opportunity to cut and run. Shareholders like that if buyers can be found. The other option is to wait and maybe that ship will come in.

The marketing geniuses in every field have worshiped at the premium offer temple for as long as sellers have been selling. Customers are told that for just a tiny bit more a whole new world of fun can be theirs. It’s popular because it works. Loss-leaders work, too.

Only so much internal austerity can hold together a media company facing external austerity, advertising retreat and digital quandary. Off-loading assets – and people – only goes so far when debt burden is compounded by inertia. Restructuring is often the best strategy but only when it goes far enough.

Only so much internal austerity can hold together a media company facing external austerity, advertising retreat and digital quandary. Off-loading assets – and people – only goes so far when debt burden is compounded by inertia. Restructuring is often the best strategy but only when it goes far enough.

Broadcasters in search of all the nice things that come from increased market share often stare down competitors at every opportunity. Earning market share is costly and time consuming, developing the digital dividend even more so. Acquisitions are either hard to come by or very expensive. Then there’s cooperation.

Free-to-air television is inextricably tied to the fickle fates of advertising. And when media buyers place their bets on the media best to attract anxious consumers reach matters less than price. Viewers have many screens on at once, after all, and seem to like everything.

Investment strategies for media houses are as diverse as the sector. There is the endless search for new opportunities through new markets or new technologies. Simply moving cash is also a major consideration. Insecurity abounds within the media world making good investments very tricky.

For commercial broadcasters in stagnant ad markets, increasing spot inventory is one strategy. Between regulation and market pressure simply adding more commercials is difficult if not impossible. One alternative is launching branded digital and web channels. There are other ideas.

Media investment strategies have certainly shifted. Private equity and venture money goes where it always does, straight for the door as soon as it can. There’s a time for it. And a time for operators to take their place.

The pain has moved to the television business. Between second screens and diminished ad revenues, big TV companies are cutting costs further, shedding assets and generally restructuring. Publishers went through this exercise and several emerged with only light haircuts. When ad and subscription revenues held on broadcasters thought they would avoid the barber: maybe not.

Tipping past the growth phase of the business cycle to the mature phase brings on new challenges for an organization, media, technology or otherwise. As it happens when a company matures the profit growth rate levels out, the cost of doing business rises. Smart organizations don’t panic, embrace the change, keep focused and avoid all the jumping up and down.

Whether they’re hawking airplanes, air-hammers or television shows, good salespeople love nothing more than having new customers to pitch. New buyers often arrive without the bias of tradition and carrying bags of money. In this converged digital world, the threshold between content and distribution blurring, successful selling requires a special language.

Whether rules are meant to be followed or broken is more than a simple debate about economic theory. Media proprietors with competitive marketplace challenges regularly walk right up to the line. Even wiggling toes over the line is considered acceptable. There are consequences, usually, for plunging in.

For commercial businesses, say free-market absolutists, no single principle carries more weight than profit. To a standard more lofty than puerile pennies comes the media sector, wearing public service, interest and values proudly. Virtue is in the beholding.

With barely a fortnight passing since the news that News Corporation will split into two, one for entertainment and one for publishing, media watchers continue to look for the tsunami that often follows an earthquake. It hasn’t materialized. Stock traders welcomed the news while newspaper people lamented, all quite expected if somewhat rehearsed. As always, there’s more to follow and veritable industry has sprung up to take the challenge.

Times are such when media companies are assessing their portfolios, shedding non-core assets and concentrating on the meat of their business. Shareholders like this. Big media companies, though, find themselves forced to discard the favorite parts.

Tough times can be opportunities for savvy investors. The secret, often, is waiting for the right moment. But patience is rarely an executive virtue, punishment being swift. Sometimes having a pile of cash helps.

Tough times can be opportunities for savvy investors. The secret, often, is waiting for the right moment. But patience is rarely an executive virtue, punishment being swift. Sometimes having a pile of cash helps.

Social media gives millions – tens of millions – their moment. Andy Warhol’s fifteen-minute rule is so last century and such an eternity. Now fifteen seconds is all you get, even with the ad.

Being a media mogul is getting tougher these days. Big competitors rally opinion against them as lesser competitors fall away. That digital dividend keeps getting more expensive. So too the politicians, now more than ever worried about opinions they might shape and money they might make.

There is an obsession in many circles with that select set of individuals who principally own big media companies. Some are reclusive and others thrive on attention. Few are at a loss for opinion on the way the world works and, certainly, the way it affects their business. And they do like things to be the way they want them.

Media owners tend to come in two distinct types. There are the hopelessly boring accountant-types, usually found in old-school companies. Then there are those who really, really like the show biz. It’s a quick guess to decide which get the most attention.

Media people continue searching for that oft promised digital dividend. So far, the major beneficiaries have been techies, telecoms and, of course, investment bankers. In the real world the difference between analogue euros and digital pennies is well understood. There is, though, a digital strategy.

The great financial crisis has caused considerable pain in the media sector. And, too, there’s been the hysteria as new media takes more and more attention space. Buy the rumor, sell the facts, say the traders.

The turns and twists continue apace from last year’s last weeks into this for media companies. New bosses are in. Old one’s out. Sometimes old one’s are back. If anything, there’s lots of shuffling, occasionally with lots of money and always with great connections.

Major media companies invest where opportunity exceeds cost. Patience, say the sages, is a virtue. But these are special times and “you’ve got to know when to fold ‘em.”

It’s a new golden age for commercial television broadcasters. The TV ad share is robust, running away from nearly all other sectors. Digital TV arrived and people are watching more, anywhere, all the time. So why all the long faces?

There are, we know, no final exams for aspiring CEO’s. We take a test before driving an automobile and several before flying a jet aircraft. There’s even, usually, an examination required to become an accountant, lawyer or brain surgeon. Those chosen to lead organizations employing and serving tens of thousands, millions arguably, arrive at the corner office by other means.

News media distinguishes itself from other enterprises with claims of a greater ethic. Bank shareholders, we’ve learned, expect and get big profits, dividends and no silly chit-chat. Are we so different?

It’s far from uncommon for politicians to call meetings with key media executives, particularly with elections on the horizon. It’s different in the UK, as we’ve seen, where Rupert Murdoch calls in the politicians. This meeting was a bit different, some witnesses calling it "strange."

It’s far from uncommon for politicians to call meetings with key media executives, particularly with elections on the horizon. It’s different in the UK, as we’ve seen, where Rupert Murdoch calls in the politicians. This meeting was a bit different, some witnesses calling it "strange."

Institutions take to aging much like the people who direct them. Few are content riding off into the sunset, warmed by fulfillment and humbled by knowledge. The quest, the game, becomes the elixir. Would that it be so easy.

Investors in television companies come in all sizes and styles. Some become operators, others players. The money in the television business just keeps on growing, which keeps investors on their toes lest one or two get broken.

There is no thrill greater than walking right up to that edge, wiggling your toes over it. Some people feel it when jumping out of a perfectly good airplane. Landing, intact, is reward of the metaphysical kind. Worrying about bad things and consequences are for wimps and little people.

The hourly revelations, charges and retorts about News Corporation have rapt the media world. Rupert Murdoch is facing, arguably, his greatest challenge. The seeds run deep and, as is said, one reaps what one sows.

Facebook frenzy erupted again. A spring 2012 IPO could be worth USD 100 billion even if growth has stalled. And the name is easier to pronounce than Icelandic volcanoes Eyjafjoell and Grimsvotn.

A great revival in media mergers and acquisitions seems ever so much closer. Financial markets are still fat with cash as are the big global media groups. Yet huge deals, big enough to rearrange the dinner table, remain just a shout away.

When a private equity firm invests in a company a clock, genetic certainly, starts ticking. Nobody hears it at first, the sound drowned out by plaudits and arriving cash. The volume increases gradually until nothing else can be heard.

Beginning in the late 20th Century, after ‘management by objectives’ and ‘in search of excellence’ had fallen away, private sector organizations uncovered new value – and new values – in serving up well-turned phrases for two increasingly important stakeholders: investors and governments. The corporate communications industry – something between lobbying and advertising – could, it said, not only add value but create it. There are, of course, limits.

Beginning in the late 20th Century, after ‘management by objectives’ and ‘in search of excellence’ had fallen away, private sector organizations uncovered new value – and new values – in serving up well-turned phrases for two increasingly important stakeholders: investors and governments. The corporate communications industry – something between lobbying and advertising – could, it said, not only add value but create it. There are, of course, limits.

Television people are masters of creativity. New shows spring up like mushrooms after a rain. But is the show the thing or is it new media distribution? It’s enough to rain on your parade.

If not exactly celebrating, media companies in many countries are breathing a sigh of relief as 2011 starts on a more positive financial note. There are evil signs out there, to be sure, as austerity programs batter consumer confidence. For many markets, East and West, the worst could be over. And then there are the others.

With media buyers spending on television like wild people and new channels blooming like spring flowers, the television business has drawn a sigh of relief from the bad days still fresh in the memory. Business is good. New media has been put in its place. Caution remains.

Positive, even stunning, year-end financial results continue to roll in from television broadcasters. Yes, ad revenues are recovering. Cost control and restructuring have their benefits but does this create a dangerous blind-spot?

It was a dreadful week. All that stirred was a constant buzz inside the head. There’d been no Murdoch news. Not a Tweet. Then, just as the drugs kicked in, a torrent.

Of all content producers, the music industry faced the digital revolution first. It has been the proverbial canary in the mineshaft. Music executives responded by fighting the Web, consumers and everybody else. The result is unsurprising.

Rupert Murdoch will reportedly fly to London this week to rally his generals for the next skirmish in a war he cannot lose. The war to gain decisive competitive advantage for News Corporation in the UK media market is one he did not expect to fight on open terrain. Battles are very hard to control.

iPad collects 30% of the revenue earned from the many media publishing apps out there but when a newspaper gives away iPad usage to a print customer then Apple loses out. So it has told some European publishers to quit the practice by April 1. Apple also has told them that all sales must be made via its iTunes store and the Europeans aren’t happy about that either, so Europe is near to declaring war on Cupertino with the first skirmish already underway.

Storytelling never really goes out of fashion. All media captivates listeners, viewers and readers with a mix of reality and fantasy spun in story form. While new media seems to reinvent that form television continues to thrive on great stories and storytellers.

Ah, the BRICs: Brazil, Russia, India and China. For several years these countries have come to symbolize rapidly developing economies. Not surprising, radio broadcasting is rapidly developing there, too.

New business models are emerging that turn newspaper companies into what they need to become -- news media companies -- with the bottom line that print becomes just one of several content platforms, with pricing to support all platforms while enabling print to maintain its niche.

The flash-bang of digital television was meant to bring more than new technology to broadcasting. More, possibly interesting channels would entice viewers and, overall, broadcasting would continue to thrive and innovate much along the same lines it had at the end of the last century. Hello, content; meet distribution.

Rupert Murdoch wants nothing more than universal acceptance of his media power. From competitors to kings, sultans to lesser politicians Clan Murdoch demands the quid pro quo for its favors. Even when it gets bigger and bigger it’s rarely rejected.

The TV battle In Italy between two titans – Prime Minister Silvia Berlusconi who is also said to be the country’s richest man – and Rupert Murdoch, said to be the world’s most influential media mogul – has heated up again.

The opening of Eastern Europe to private, commercial broadcasting was met with massive investment. In those two decades consumers have changed their habits. Advertisers have changed their spending. Broadcasters have responded with totally new strategies.

The British media and some of the Establishment have put Rupert Murdoch under enormous pressure lately for offering to buy all of BSkyB that he doesn’t already own, and for alleged telephone hacking by his News of the World tabloid. He had a golden opportunity at the inaugural Thatcher Lecture to throw some daggers of his own but, regretfully, it was Rupert the Diplomat choosing his words very carefully.

No business stays in business when the cost of doing business exceeds what the customers will pay. Accounting tricks notwithstanding, bottom line management is the norm. But unlike in the restaurant business, media operators can’t eat their mistakes.

No business stays in business when the cost of doing business exceeds what the customers will pay. Accounting tricks notwithstanding, bottom line management is the norm. But unlike in the restaurant business, media operators can’t eat their mistakes.

Getting British media to agree on anything is near impossible, but now newspapers ranging from the far right to the far left are united against a common enemy – Rupert Murdoch. And the referee in this fight is a decidedly uncomfortable coalition government that probably wishes the whole thing would just go away.

Big media deals come together for many reasons. Usually it’s the money, sometimes it’s the power. Almost always it’s the trill of the really big deal.

A world record for street singing made the headlines during the German music industry trade fair Popkomm. Singing for ones supper, literally or figuratively, may be the norm for the lesser known artists and performers. Music industry executives and their lawyers have a different tune.

Jimmy Wales, founder of Wikipedia, says the Murdoch paywall at the Times and Sunday Times in the UK is a “foolish experiment” mainly because their readership online has dropped so drastically diminishing those newspapers’ influence in today’s social media digital world. But to Rupert Murdoch it’s all about the bottom line, knowing precisely who your readers are, and making them pay. Who has it right?

Yet more evidence pours in; that nasty recession is over. Or maybe it’s mostly over. In any case, television – advertising included – is still hot.

It’s great military theater when two media barons go at it and the artillery fire between Silvio Berlusconi, Italian Prime Minister and head of Mediaset, and Rupert Murdoch, whose News. Corp owns the Sky Italia satellite TV service, has just heated up a notch or two.

Television news is an everyday challenge. Everybody wants more, better, faster yet there’s considerable cost. As new media makes everything available to anyone business plans constantly change. And competitors want to eat you.

For media companies, foreign development carries risk and reward. Expansion opportunities beyond home borders advance on business models well-honed by experience. The best plans, though, can be laid to waste by changing local politics.

For media companies, foreign development carries risk and reward. Expansion opportunities beyond home borders advance on business models well-honed by experience. The best plans, though, can be laid to waste by changing local politics.

The bid by Rupert Murdoch’s News International for the 60.9% of British satellite TV BSkyB that it doesn’t own for a price that could well end up close to $8 billion – about what the company now has in the bank – is opening hornet nests on both sides of the Atlantic.

Corporate strategies among the biggest media companies are remarkably consistent. Those traded publicly, or significantly so, trade on a stony conservatism that resists risk. News Corporation has always been different.

Behind the scenes the dialogue is getting downright personal over Thomson Reuters CEO Tom Glocer’s public blog defense of major client Goldman Sachs, and also over complaints by former staff of the perceived lackluster company response to the leaked military footage showing two Reuters people shot dead in Iraq by the US military.

Buzz, buzz, buzz; it’s MIPTV. With so much buzzing and twittering how can there be enough time or energy for the PR parties. Television luminaries are buzzing about adapting to converging realities.

Media organizations always follow the money. Even with advertising shifting and the internet looming large the business model always remains true to attracting audience. Television in Slovenia has talent.

Television series come and go with a predictable frequency. Viewers grow weary, ratings slip, actors call their agents, sponsors blink. Broadcasters wield the axe. All move on. Television loves winners and doesn’t tolerate the rest.

Austerity cost cutting and a little creative accounting saved media giant Bertelsmann from the revenue demons of 2009. Dividends were cut in half but things will “significantly improve” this year. The “course for growth” is digital.

In the first truly welcome sign of economic recovery, Forbes magazine says there are now more billionaires than ever. And billionaires like the media business. Spread the word. The boys are back… with cash.

In the first truly welcome sign of economic recovery, Forbes magazine says there are now more billionaires than ever. And billionaires like the media business. Spread the word. The boys are back… with cash.

Few weeks pass without some major media entity announcing major expansion in the Arabian Gulf region. Last week it was Rupert Murdoch saying News Corp. was centering various Middle East operations in Abu Dhabi, CNN has opened what it calls a state-of-the-art regional center there and already broadcasts a daily news program plus various weekly programs, CNBC has announced it is creating a regional editorial hub in Bahrain and don’t forget the gleaming Dubai Media City that opened its doors in 2001 hosting various international media entities in a tax free zone.

When Rupert Murdoch speaks, people usually listen. They may not necessarily agree, but they listen. So when Murdoch opened a Middle East media summit this week by telling Arab states they if they wish to be seen as embracing modern media, which they do, then they must also accept press freedom no matter how “inconvenient or unwelcome” some stories may be.

Rupert Murdoch caused a stir this week when he said he doubted the rumors that the Sulzbergers might sell The New York Times to Mexican billionaire Carlos Slim. “I don’t believe it,” Murdoch said, “The family treats it as a great heritage,” and if the family were to sell, he added, it would be “least of all to a Mexican.”

The business of big-time television has never been without drama, on and off the screen. Add the tensions of disappearing ad revenue, audiences scattering and competitors on the Web and mobile phones and it’s a war out there. And, perhaps, it’s a good time to keep the fighting outside the building.

UK satellite broadcaster BSkyB has given up most of its stake in terrestrial television broadcaster ITV.

The candidate taking Ukraine’s presidency will face a changed country. Before the 2004 Orange Revolution Ukraine’s media reflected the country’s dull, post-Soviet persona. That has changed.

The candidate taking Ukraine’s presidency will face a changed country. Before the 2004 Orange Revolution Ukraine’s media reflected the country’s dull, post-Soviet persona. That has changed.

Avatar and the TV business helped News Corporation blast a 66% earnings per share improvement in Q2 over a year ago, but not very much was said about the contribution by newspapers that actually did 30% better but only because of a strong Australian dollar, continuing savage cost-cutting, and some ad growth at The Wall Street Journal. And as if Murdoch the elder doesn’t have enough hours in the day figuring out how to boost print revenues he now has to deal with his kids and sons-in-law causing a ruckus.

A year and a half ago News Corp Premier Rupert Murdoch said he’d be clearing out of Russia and other Eastern European holdings. He’s found it easier said than done.

Ah, the first decade of the 21st century is now a memory, mostly a bad memory. Let’s reflect on the state of affairs, look for the ‘silver lining’ or just enjoy the Holidays. 2010 will be here soon enough!

That politicians seek to control media is the single, universal truth in the relationship between politicians and media. The most authoritarian politicians demand absolute authority over media. More often than not the politicians win. There are no exceptions.

News has an almost scared place on television channels. Games shows and comedies may rake in the ratings but news programs have been essential to television channel branding. That may be ending.

News has an almost scared place on television channels. Games shows and comedies may rake in the ratings but news programs have been essential to television channel branding. That may be ending.

Carlo de Benedetti chose the very public foreign forum of an Oxford University lecture to let Italian Prime Minister Silvio Berlusconi have It, verbally speaking, right between the eyes while at home Rupert Murdoch’s Sky Italia, after announcing it will launch a free digital terrestrial station in December, is distributing a USB key that will allow Sky desktops to access Mediaset’s free digital terrestrial channels – and without those Sky subscribers having a Mediaset desktop how can it sell its pay platforms?

A tie up between News Corporation and Microsoft Corporation is in the air. Sure, it’s insane. But credit both Murdoch and Ballmer for previewing the first truly post-modern publisher.

Privately owned commercial broadcasting has come into its own during the last two decades. There have been struggles, successes and more struggles. Public sector competitors can be tough, governments might not understand and advertisers are, today, hard to find. Programming, decisive and unique, continues to draw audiences.

Every turn and twist for the media world in this century has seemed like a game-changer. Between playing ‘chicken’ or running from one idea to the next like a headless chicken the great new media business model is still hiding. Maybe we’re missing the obvious.

A bit of restructuring at two of Russia’s television channels looks to some like the cloud of Soviet times descending. All things Russian appear mysterious, not the least being its media. When times are tough, the tough make plans.

Suddenly it’s not all going Silvio Berlusconi’s way. He lost immunity from prosecution when Italy’s highest court ruled his own law protecting him wasn’t valid; his Finninvest company lost big-time in a civil suit to arch-foe Carlo de Benedetti (Finninvest order to pay up €750 million), and there are reports that de Benedetti may be a key to get Rupert Murdoch, Berlusconi’s public villain number 1, into terrestrial digital broadcasting which is the last place that Berlusconi wants him. The war is still very much on.

Suddenly it’s not all going Silvio Berlusconi’s way. He lost immunity from prosecution when Italy’s highest court ruled his own law protecting him wasn’t valid; his Finninvest company lost big-time in a civil suit to arch-foe Carlo de Benedetti (Finninvest order to pay up €750 million), and there are reports that de Benedetti may be a key to get Rupert Murdoch, Berlusconi’s public villain number 1, into terrestrial digital broadcasting which is the last place that Berlusconi wants him. The war is still very much on.

Television’s future is not in doubt. There are channels and there are viewers. The way they connect is in the throws of change. And so is the stuff in between.

Tight economics forces broadcasters to squeeze everything and everybody. What once might have been advantageous synergy quickly becomes opportunity for competition. News is a business, too.

There’s a problem at ITV. There’s also a problem surrounding ITV. The shareholders need to solve both. That might mean the nuclear option.

The urge to merge is more powerful than ever for media companies in Europe. Of course, there are the inevitable synergies. While regulators take a very hard look, the economics favor more consolidation.

The collapse of investment bank Lehman Brothers a year ago this week spawned panic across much of the media world. The jolt that rattled global finance tore into broadcasters and publishers, advertisers and consumers. Everything changed, or so it seemed.

Troubled times need clear minds. It’s proving increasingly clear that the media world’s blur about what’s new and what’s old – and what works and what doesn’t - is just as wrong today as it was two years ago or twenty.

Commercial television investors enter markets based on several factors. Most certainly, the leading decision point is cost of entry. Revenue potential is a close second. Next is strength of competitors.

Commercial television investors enter markets based on several factors. Most certainly, the leading decision point is cost of entry. Revenue potential is a close second. Next is strength of competitors.

Few now believe business conditions for media in Russia and other former Soviet States will ‘normalize’ in any acceptable time frame. Media investors who arrived over the last two decades expecting surges in consumer industries to overpower entrenched divisions are fleeing.

Media mergers and acquisitions may rise in the second half of the year. Financial investors are prowling as big companies try to get out from under debt. Always illusive synergies are still hard to grasp.

Without doubt every stock-trader, News Corp shareholder and most of its employees sit up straight in the chair at each of Mr. Murdoch’s pronouncements. Last week very sour financial results were overwhelmed by his final verdict on the news business and the Web. They will pay, he says.

The big shots of media got together last weekend at a retreat and the number one question they discussed was how they can make money off the Internet. The end result: they knew the general answer – charge for content – but they still haven’t figured out how and for what.

Not long ago Eastern Europe had the reputation as a major growth region for commercial media. Well-financed investors – strategic and financial – moved in. With revenue projections returning from the stratosphere a tougher look at means a smaller portfolio.

With media entities financially in pain, are news agency subscriptions sacrosanct? The AP has resorted to major rate decreases in the US to stop a cancellation revolution and in Germany DPA lost its second biggest newspaper group client for a far less expensive news source. Which raises the question of whether current news agency business models are running past their due date?

With media entities financially in pain, are news agency subscriptions sacrosanct? The AP has resorted to major rate decreases in the US to stop a cancellation revolution and in Germany DPA lost its second biggest newspaper group client for a far less expensive news source. Which raises the question of whether current news agency business models are running past their due date?

Some investors see complicated markets and ask ‘Why?’ Others, with a twinkle, say ‘Why not?’ Eastern Europe attracts the bold, the brave and, maybe, the crazy.

Since the dot.com bubble burst as this century began financial modelers have moved from irrational exuberance to caution to fear. With the dramatic unhinging of worldwide financial markets forecasters maintained a shred of optimism about the media and entertainment industries. Improvement would come, they said even into this years’ first quarter, in a year or so. The shred of optimism is being shredded.

One of life’s great joys is watching two media barons battle it out using all the weapons at their command (Murdoch is getting real close to the waistline on personal issues; Berlusconi got too close to the waistline on business issues) but at the end of the day while Murdoch may be embarrassing Berlusconi outside of Italy inside the country the prime minister is doing just fine.

Ireland’s fall from economic grace is taking a toll. The tide may be turning but it’s a screw too tight to keep the country’s media sector from pain. Things add up and there’s no bail out in sight.

Trade publications have a special role within any business sector. At their very best they tell the stories within an industry or trade, giving voice to insiders in their own language and sometimes fighting their fights. As a business trade press is generally considered reasonably recession proof. That’s not enough when an entire industry moves to the other side of the curve.

The scariest word in the media lexicon is change. Old guys hate it, often because young guys preach it. Business practices change. Words change. People change. There’s no need for an anxiety attack.

The scariest word in the media lexicon is change. Old guys hate it, often because young guys preach it. Business practices change. Words change. People change. There’s no need for an anxiety attack.

Few, if any, media companies are escaping the ad slump. Directors and stock traders are showing little patience. Cut costs, dump non-core investments and change the CEO, they say.

Last week was slow for media news. That gave plenty of attention to the “malfunctioning” of media’s business model, according to Rupert Murdoch. Everything The Elder says is staged, just like Janet Jackson’s wardrobe “malfunction.”

In the front lines of the media world there’s no need for another expert reporting the obvious. Each week brings another irritatingly real story of causalities where media and money intersect. Big media is still big, says a new study; just a bit less so.

There is mounting recognition across the UK media spectrum that regional television news production in competition with the BBC has hit the financial wall. The UKs private sector media has, largely, been operated like an automobile on ice in a tunnel driven at high speed by a drunk on a suicide mission. The solution, they say, is jet fuel.

Big television operators swamped by huge debt and overwhelmed by lower ad revenues are feeling considerable pain. Pressure, certainly, is on top executives. Last week saw ITVs chief executive Michael Grade and ProSiebenSat.1 Media COO Patrick Tillieux announce their departures.

Big television operators swamped by huge debt and overwhelmed by lower ad revenues are feeling considerable pain. Pressure, certainly, is on top executives. Last week saw ITVs chief executive Michael Grade and ProSiebenSat.1 Media COO Patrick Tillieux announce their departures.

Before the end of this year Michael Grade will relinquish his role as ITV chief executive. He never meant to remain the day-to-day executive and the announcements timing set twits twittering and clocks ticking. The mark of a true showman is knowing when to leave the stage.

What is it the financial experts know that the rest of us don’t as they make their multi-million dollar investments in the newspaper industry, this time with the news that Aerial Capital of Chicago now owns 28.8 million Gannett shares, giving it about a 12.5% ownership compared to a 4.9% ownership before?

Recession hit media executives are hearing from their bankers, regulators and even family members. The big question: ‘What are you going to do and when?’ Everybody, it seems, wants to rearrange the landscape.

Unfolding before our eyes is a television future for those who want more, easier and, perhaps, smaller. Broadcasters have no choice but to experiment with new media. Viewers are adapting the medium to the times as well as their interests.

Some corners of British media are gasping for air. Others are holding their breath. The oxygen is being sucked out.

Watching two media billionaires fight it out for broadcast supremacy in Italy reminds one of the fight to the death of the ancient gladiators, but this fight is not just in the Colisseum – it covers the whole country and right now the crowds are showing “thumbs up” for both.

Top rank executive shuffling can have a range of meanings. Although large organizations are notoriously resistant to change, one enduring management lesson is “change the people or they change you.”

Top rank executive shuffling can have a range of meanings. Although large organizations are notoriously resistant to change, one enduring management lesson is “change the people or they change you.”

The drumbeat pounds louder and more frantic for a new business model for media. Nothing really new or really healthy has come of it. Addictions are tough to break and advertising is the toughest. But present day economics is calling the tune. It’s time to sing along.

Besides the bonus that the McClatchy board says CEO and chairman Gary Pruitt won’t get this year, he still draws a $1.1 million salary which the Guild at his flagship Sacramento Bee suggested should be cut by half, to the $500,000 limit the Obama administration is placing on banking top executive salaries who take government money. Instead, Pruitt gave up just 15% and still earns $935,000.

In all of the announcements in the US and British press about Reuters launching a new financial TV service in June, there wasn’t one word that the company actually had a very successful financial TV service which current management killed off seven years ago as a cost savings. Just goes to show, what goes around, comes around!

The power of powerful media organizations is in gaming financial and strategic investments for maximum value. Turbulence only makes the game more interesting. News Corporation may set adrift investments, even good ones, but rarely does it scuttle one it believes in.

The power of powerful media organizations is in gaming financial and strategic investments for maximum value. Turbulence only makes the game more interesting. News Corporation may set adrift investments, even good ones, but rarely does it scuttle one it believes in.

News Corp. has enough cash in the bank to pay off its debt for the next seven years, so Rupert Murdoch probably doesn’t dwell too much on how much he paid for Dow Jones, that he has just written down that investment by half --$2.8 billion -- and that hard times have now meant journalistic cuts at his beloved Wall Street Journal and his four UK national newspapers, but the Bancroft family must consider him an absolute savior.

Everyone knows 2008 was a media disaster, for newspapers in particular, but it really hits home now that the analysts have translated the raw data and have proclaimed that one in 11 US newspaper jobs disappeared last year.

Location, of course, plays to the advantage of the World Economic Forum being in Davos, Switzerland. It’s tough getting there. Ten hours by train from Geneva when the helicopters are all booked. Even at that the WEF seems a million miles from anywhere, which is, of course, the point.

Location, of course, plays to the advantage of the World Economic Forum being in Davos, Switzerland. It’s tough getting there. Ten hours by train from Geneva when the helicopters are all booked. Even at that the WEF seems a million miles from anywhere, which is, of course, the point.

Students of management and almost anyone who has worked for a large organization know about the proximity effect. Results decrease proportionate to geographical distance from headquarters. Tantalizing evidence piles up showing far-flung divisions outperform those nearest the boss.

Even the high and mighty are being economically squeezed and that means that Google is cutting out what it considers superfluous projects and concentrating on its core revenue producers. So promises of the past – even two week old promises – no longer hold water.

There’s little doubt 2009 will be a year of plenty, plenty of pain. Media, big and otherwise, mirrors their audience in risk aversion. For many, survival will be the reward.

There’s little doubt 2009 will be a year of plenty, plenty of pain. Media, big and otherwise, mirrors their audience in risk aversion. For many, survival will be the reward.

These are dark days to be making newspaper deals, but they are still getting done, albeit in the small to mid-size markets. A buyer has come forward for the two newspapers in Connecticut that the Journal-Register Company had threatened to close down, and in Maine the Blethen family has a deal for their three dailies, but had to extend the deadline while the buyers continued to try and come up with the financing. No one said that even at very low prices it was going to be easy.

Multi-national publisher Mecom Group has become the most recent poster child for debt rattled publicly traded media companies. Once – and not long ago – the darling of rapturous financial projections it now can’t meet debt covenants exceeding €600 million, a figure that has increased more than ten-fold since the rapture. Media companies are becoming sub-prime, er, toxic.

Multi-national publisher Mecom Group has become the most recent poster child for debt rattled publicly traded media companies. Once – and not long ago – the darling of rapturous financial projections it now can’t meet debt covenants exceeding €600 million, a figure that has increased more than ten-fold since the rapture. Media companies are becoming sub-prime, er, toxic.

In the great scheme of things, Moldova gets very little attention except from wine fans and the occasional political observer. Big media operators, however, have been rather active. Is Moldova the next media hot spot?

Big media is moving on. It’s the one constant even in times of turmoil. Broadcasters change, renew, adapt, fall flat, try again, win some, lose some. Executives take this change in stride. Recent corner office changes at big league broadcasters show just how much change is in the air.

A question posed by an ftm reader is simple enough. What real world examples are out there of financially sustainable news websites? Opportunity abounds on the internet domains. Cold hard cash is harder to find.

A question posed by an ftm reader is simple enough. What real world examples are out there of financially sustainable news websites? Opportunity abounds on the internet domains. Cold hard cash is harder to find.

That media is going through significant transition is a given. Old media will ride off into the sunset. If history gives any clue media is entering the best of times. And it will be a wild ride.

The German economy passed an unfortunate threshold, officially entering the recession zone. German media companies noticed, worried as ever, and moved into deeper restructuring. Some of it has been long in the planning and some not.

The German economy passed an unfortunate threshold, officially entering the recession zone. German media companies noticed, worried as ever, and moved into deeper restructuring. Some of it has been long in the planning and some not.

As the financial world restructures with public guarantees media providers scramble for their own. It will be two steps backward as people with the money tidy up their accounts. Write offs in the tech sector may bring the digital dreams back to earth.

Anybody who is anybody in the television business is in Cannes this week. There are people to see. There are deals to be made.

TV 2 Radio has become Nova FM. It’s the second time in two years a national commercial radio channel in Denmark failed financially and had to be taken over by somebody braver than the last. And the Culture Minister is proposing more national FM channels. Danes, you know, are the happiest people in the world but confusion doesn’t bring smiles.

TV 2 Radio has become Nova FM. It’s the second time in two years a national commercial radio channel in Denmark failed financially and had to be taken over by somebody braver than the last. And the Culture Minister is proposing more national FM channels. Danes, you know, are the happiest people in the world but confusion doesn’t bring smiles.

Southeast Europe is vitamin-rich and may have the nourishment big media companies need. RTL Group just bought a majority of a Greek radio and TV company. Bulgaria, Romania, Turkey and the Balkans are enticing strategic and financial media investors as other markets brace for winters’ chill.

Southeast Europe is vitamin-rich and may have the nourishment big media companies need. RTL Group just bought a majority of a Greek radio and TV company. Bulgaria, Romania, Turkey and the Balkans are enticing strategic and financial media investors as other markets brace for winters’ chill.

The media has been rushing the past few years to put all its breaking news on the Internet for free, and while at it, might as well put the features, investigative pieces, in fact just about everything there! And by golly, Internet readership shot up while print circulation fell. Why buy the newspaper when that news is on the Internet for free? So what that Internet ads are bringing in only 12% of what a print ad does? Could it be that the free news on the internet business model isn’t all it’s cracked up to be, or put another way, is that mirror cracked?

There was a day last week when Media General’s shares actually closed up 111.3% higher than the day before ($8.66/$18.30) all because it announced that while its August results were still rotten, and no reason to believe the rest of the year will be any better, it was still the best month so far this year. Over at the New York Times, where they announced Internet revenue was up even though print revenues were awful, there was a 12% jump. So is everything all better now in newspaperland? Don’t you believe it!

Television can be compared to a zoo. Build a park, bring in the animals and the curious line up to pay their €10. The animals are fed, ticket-takers are paid and the curious return to the real world after a nice afternoon. But the animals are demanding holidays, pensions and open cages, the ticket-takers are telecoms, zoo-keepers investment bankers. Will the curious be trampled when the elephants start dancing?

Television can be compared to a zoo. Build a park, bring in the animals and the curious line up to pay their €10. The animals are fed, ticket-takers are paid and the curious return to the real world after a nice afternoon. But the animals are demanding holidays, pensions and open cages, the ticket-takers are telecoms, zoo-keepers investment bankers. Will the curious be trampled when the elephants start dancing?

In comes News Corps pick for CEO at German pay-TV channel Premiere. It “came unexpectedly,” said the new guy. Also unexpectedly came prosecutors to News Outdoor’s Moscow office. So JCDecaux could sweep away that problem. Expect the unexpected, no?

Trend spotting is a delicate art. Whether consumer trends or financial trends, waves of the future appear to the truly gifted. And today, there’s always a press release. Somebody always finds good news in any trend.

A certain coolness is flowing across the Northern Hemisphere, even as summer keeps its tentative grip. The tough vice of economic chill and advertiser wariness (or weariness) is clamping hard on media companies big and small.

The controversy over satellite operator Eutelsat cutting off a broadcaster beaming into China continues to simmer. EC Info Society and Media Commissioner Viviane Reding wants to know “what exactly is going on,” said a spokesperson. Suspicions of the suspicious are that Eutelsat was pressured to cut off Chinese-language NTDTV.